EITC—A Federal Tax Refund: April 15

Penn’s Tax and International Operations shared the following message from the City of Philadelphia concerning EITC, a federal tax refund.

What is EITC?

EITC is a federal tax refund available to working individuals and families. The average refund amount in Philadelphia is $2,500, so hurry and find out if you are eligible. The deadline to file is April 15, 2019.

How do I know if I’m eligible?

You are eligible if:

- You (and your spouse, if filing a joint return) have a valid Social Security Number (SSN),

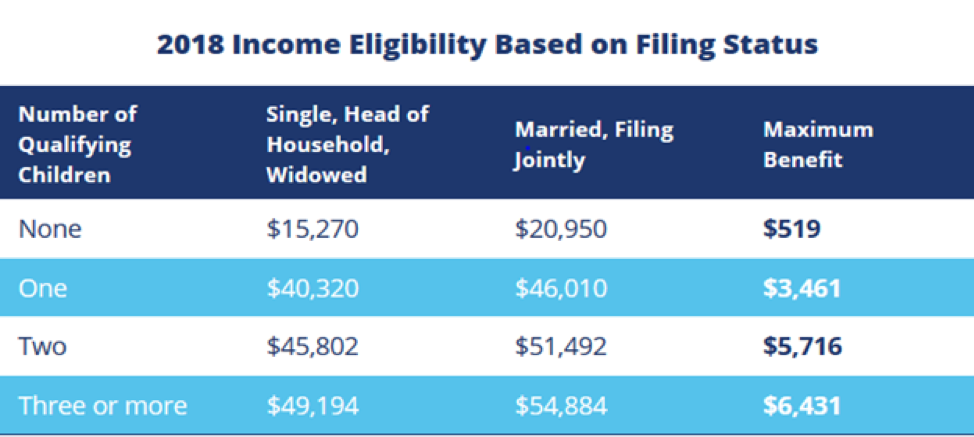

- Your 2018 earned income is within the limits (shown above),

- You are 25 to 65 years of age OR

- You have a qualifying child

Here is all you need to do:

- File your federal tax return

- Complete the EITC form

It’s free.

We know you want your tax refund ASAP, but to avoid paying service fees of up to 40 percent of your refund, skip the for-profit tax prep services and file with the City of Philadelphia’s free, IRS-certified tax preparers. That way, you’ll get back the full amount of your refund.

Your benefits are safe.

EITC does not count as income. So no matter how much you get back, you’ll still be eligible for any government assistance programs you are enrolled in.

There’s still time.

If this is your first time filing for EITC, you should know that your income for 2015, 2016 and 2017 is also eligible. So you could get back even more than this year’s maximum of $6,431. File for 2015, 2016 and 2017 to get up to four times the maximum refund.

There is no reason not to file. It’s your money. So go get it! It’s easy and free. Text “FILE” to 99000 or visit www.YouEarnedItPhilly.com to find locations of free tax preparers near you.

The deadline is April 15–don’t wait!