Tax Forms for 2017

The University’s Tax and International Operations Office will again utilize ADP W-2 Services for year-end 2017.

The University’s Tax and International Operations Office will again utilize ADP W-2 Services for year-end 2017.

Services Available:

1. Access W-2 form information for tax years 2015 and later

2. Opt out of printing W-2 (must elect by 12/31 of the current year)

3. Receive email notification when a new statement is available to view (must enter email address into ADP)

4. Upload W-2 form information directly into tax software

5. Online help and FAQ

To Access:

1. Login to ADP W-2 Services from the following U@Penn secure web site: https://medley.isc-seo.upenn.edu/penn_portal/u@penn.php

2. Click on “My Tax Info” (enter additional security information)

3. Click on “Click here for W-2 information for tax years 2015 and later”

4. Enter your birthday and the last four digits of your SSN and click “Continue”

Please note that W-2 Forms were mailed to employees’ permanent addresses as it appeared on the Payroll/Personnel File (Employee Database).

If the permanent address was not completed on the Payroll/Personnel File, the W-2 Form was mailed to the current address.

W-2 forms for 2012 and prior will still be accessible under “My Tax Info.”

Contact the Tax Office for W-2 forms for tax years 2013 & 2014 at (215) 898-6291 or send a request through the Tax Helpdesk at: https://www.finance.upenn.edu:44301/apps/TaxHelpDesk/

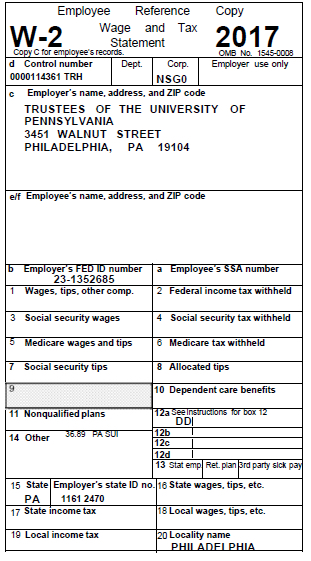

An explanation of the contents of the various boxes on the W-2 Form is as follows:

Box a: Employee’s social security number. This is your Social Security Number. It should match the number on your social security card. If the number is incorrect, please provide your Social Security card to the Tax Department. The Tax Department will update and issue a corrected W-2 Form.

Box b: Employer identification number (EIN). This is your employer’s identification number assigned by the IRS.

Box c: Employer’s name, address, and ZIP code. This identifies the name, address, city, state, and zip code of your employer.

Box d: Control number. This is a code that identifies this unique W-2 Form document in your employer’s records. It is an optional field and may be left blank.

Box e: Employee’s name. This identifies your full name (first name, middle initial and last name). Your name must match the name on your social security card. If the name is incorrect, please provide a copy of the Social Security card to the Tax Department. The Tax Department will update and issue a corrected W-2 Form.

Box f: Employee’s address. This identifies your address, city, state and zip code.

Numbered Boxes on W-2 form:

Box 1: Wages, tips, other compensation. Box 1 reports your total taxable wages or salary for federal income tax purposes. This figure includes your wages, salary, tips reported bonuses and other taxable compensation. Any taxable fringe benefits (such as group term life insurance) are also included in your Box 1 wages. Box 1 does not include any pre-tax benefits such as savings contributions to a 401(k) plan, 403(b) plan, health insurance, or other types of pre-tax benefits.

Box 2: Federal income tax withheld. Box 2 reports the total amount withheld from your paychecks for federal income taxes. This represents the amount of federal taxes you have paid-in throughout the year.

Box 3: Social security wages. Box 3 reports the total amount of wages subject to the Social Security tax for 2017. The Social Security tax is assessed on wages up to $127,200 (for 2017). This limit is called the Social Security wage base.

Box 4: Social security tax withheld. Box 4 reports the total amount of Social Security taxes withheld from your paychecks. The Social Security tax is a flat tax rate of 6.2% on your wage income, up to a maximum wage base of $127,200 (for 2017). Wages above the Social Security wage base are not subject to the Social Security tax. Accordingly, the maximum figure shown in Box 4 should be $7,886.40 ($127,200 maximum wage base times 6.2%). If you have two or more jobs during the year and your total Social Security wages (Box 3) exceeds $127,200, you may have paid-in more Social Security tax than is required. You claim the excess Social Security tax withholding as a refundable credit on your Form 1040.

Box 5: Medicare wages and tips. Box 5 reports the amount of wages subject to the Medicare tax. There is no maximum wage base for Medicare taxes.

Box 6: Medicare tax withheld. Box 6 reports the amount of taxes withheld from your paycheck for the Medicare tax. The Medicare tax is a flat tax rate of 1.45% on your total Medicare wage under $200,000. Employees whose Medicare wages are over $200,000 will be subject to an additional withholding for the additional Medicare Tax at a rate of 0.9% on Medicare wages over the $200,000. This is a rate of 2.35% on all Medicare wages over $200,000.

Box 10: Dependent Care benefits. Shows the total dependent care benefits under a dependent care assistance program paid or incurred by the employer for the employee and amounts paid or incurred for dependent care assistance in a section 125 (cafeteria) plan. It may include the amounts paid directly to a daycare facility by the employer or reimbursed to the employee to subsidize the benefits, or benefits from the pre-tax contributions made by the employee under a section 125 dependent care flexible spending account. Any amounts over $5,000 are also included in boxes 1, 3 and 5.

Box 12: Deferred Compensation and Other Compensations. There are several types of compensation and benefits that can be reported in Box 12. Box 12 will report a single letter or double letter code followed by a dollar amount. A complete list of the codes can be found on the box instructions on the W-2 Form. These are the most common codes found on Penn’s W-2 Form:

Code C: Taxable cost of group term-life insurance over $50,000. This amount is included as part of your taxable wages in Boxes 1, 3, and 5.

Code E: Non-taxable elective salary deferrals to a 403(b) retirement plan.

Code G: Non-taxable elective salary deferrals and employer contributions (including non-elective –deferrals) to a Section 457(b) retirement plan.

Code M: Uncollected Social Security or RRTA tax on taxable group term life insurance over $50,000.

Code N: Uncollected Medicare tax on taxable group-term life insurance over $50,000.

Code P: Excludable moving expense reimbursements paid directly to employee (not included in Box 1, 3 or 5).

Code T: Employer paid adoption benefits. This amount is not included in Box 1 wages. Use form 8839 to calculate the taxable and non-taxable portion of these adoption benefits.

Code W: Employer and employee contributions to a Health Savings Account (HSAs).

Code Y: Salary deferrals under a Section 409A non-qualified deferred compensation plan.

Code Z: Income received under 409A non-qualified deferred compensation plan. This amount is included in taxable wages in Box 1. This amount is subject to an additional tax reported on the employee’s Form 1040.

Code BB: After-tax contributions to a Roth 403(b) retirement plan.

Code DD: Reports the cost of employer-sponsored health coverage. The amount reported with Code DD is not taxable

Box 13: Checkboxes. There are three check boxes in Box 13. The only box that may be checked off that applies to you as an employee of the University is the Retirement Plan. Retirement plan means that you participated in your employer’s retirement plan. If the “Retirement plan” box is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub. 590, Individual Retirement Arrangements (IRAs).

Box 14: Other Tax Information. Your employer may report additional tax information in Box 14. If any amounts are reported, they will have a brief description of what the amounts are for. For example, SUT represents the amount of State Unemployment Tax which was withheld from your earnings during the year.

Box 15: State and State Employer’s Identification. Box 15 reports the state and your employer’s state tax identification number.

Box 16: State wages. Box 16 reports the total amount of taxable wages earned in that state. You may have multiple state W-2 forms if you worked in other states during the year.

Box 17: State income tax withheld. Box 17 reports the total amount of state income taxes withheld from your paychecks for the wages reported in Box 16.

Box 18: Local wages. Box 18 reports the total amount of wages subject to local income taxes. You may also have multiple local W-2 forms if you worked in more than one locality during the year.

Box 19: Local income tax withheld. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes.

Box 20: Locality name. Box 20 provides the name of the locality where the tax is being paid.

2018 Payroll Tax Updates

Federal Taxes: The federal withholding tax tables for 2018 can be found in the IRS Publication 15 at: http://www.irs.gov/pub/irs-pdf/p15.pdf

Social Security Wage Rate: The 2018 Social Security wage base is $128,400.

Social Security Tax Rate: The 2018 tax rate remains at 6.2% and the maximum tax that an employee would pay will be $7,960.80.

Supplemental Pay Withholding: Withholding on payments less than $1 million in a calendar year has been reduced to 22% for 2018 from 25% in 2017 and withholding for payments in excess of $1 million in a calendar year has been reduced to 37% for 2018 from 39.6% in 2017.

Medicare Tax Rate: The Medicare tax rate remains at 1.45% in 2018 for wages under $200,000. Wages in excess of $200,000 are taxed at 2.35%.

PA State Unemployment Insurance Employee Rate: The tax rate decreased from at 0.07% in 2017 to 0.06% for 2018.

PA State: The tax rate for 2018 remains at 3.07%.

Philadelphia City: As of July 1, 2017, the Resident Rate is 3.8907% and Non Resident Rate is 3.4654% and remains the same for the beginning of 2018.

—Victor Adams,

Tax and International Operations