HUMAN RESOURCES

Health Care and Penn

Health care has been the

recent focus of much discussion in

the media and in the political arena.

With the annual health benefits Open

Enrollment period approaching next

month (April 14-25), it is also a

timely topic here at Penn. Throughout

the months of March and April, Human

Resources will be sending out information

about health care. Some materials

will be sent to your home address,

some to your intramural address. In

addition to those materials, Almanac will

be running a multi-week series of

articles focusing on health care and

Penn. This one gives a background

on the nationwide issue of rising

health care costs and how Penn's costs

compare to other employers. Future

articles will discuss topics such

as changes that Penn will be making

to help deal with this issue and what

you can do to contain your own costs,

as well as specific information about

Penn's Open Enrollment period.

Health Care Costs Continue to Skyrocket

Rising health care costs

have been a nationwide topic of concern

over the past several years. Within

the past 5 years alone, the overall

cost of health care for large employers

(10,000 employees or more) has increased

nearly 47%, according to a study by

Hewitt Associates, a global human

resources and benefits consulting

firm. In 2002, employers absorbed

the biggest annual cost increase in

over 10 years. And experts can see

no end to these skyrocketing cost

trends in the near future.

Penn has not remained untouched

by this phenomenon. We experienced

a 13% increase in health care costs

in fiscal year 2002, over 9 times

the inflation rate of 1.4% for that

same year. Our spending for health

care totaled $65 million! Without

cost controls, that $65 million expense

is expected to double in a

mere 5 1/2 years.

Why are Health Care Costs Rising?

Many of the reasons for these

rising costs go beyond the control

of employers. For example, prescription

drug costs have been the fastest growing

expense, projected to grow at 20%

to 30% annually. New, more expensive

drugs are constantly being introduced.

Plus, pharmaceutical companies have

stepped up their direct-to-consumer

marketing, increasing the demand for

and utilization of these drugs. The

combination of these factors has caused

drug costs to rise at an alarming

pace.

Another cost driver for health

care is an issue that has gained a

lot of press lately: the number of

uninsured in America. As noted in

a recent article on Penn's Knowledge@Wharton

website, http://knowledge.wharton.upenn.edu/,

many experts agree that insuring the

uninsured is the nation's top health

care issue. More than 41 million people

across the country do not have health

insurance, a situation that contributes

to rising health care costs in many

ways. For example, those without insurance

may choose not to pay for the relatively

inexpensive preventive care that can

help prevent serious illnesses. Then

when the uninsured become seriously

ill, this costly care must be paid

for somehow·and those costs are typically

passed on to those who do have insurance,

in the form of higher premiums.

Added to these factors are

the realities that Penn's employee

population is aging, and people are

simply using more health care services

these days. These are some of the

major influences on Penn's cost increases,

as our participants tend to utilize

our plans on a higher-than-average

basis. At the same time, the costs

of these health care services are

on the rise, due to factors such as

high-priced advances in medical technology

and treatment, and exorbitant malpractice

insurance premiums. This high usage

of increasingly more expensive benefits

leads to even higher costs for the

University.

How does Penn compare?

Hewitt Associates gathered

benchmarking data from large employers

nationwide (representing over 17 million

health plan participants) to compare

Penn's health care information with

local and national averages. The local

market data was gathered from Philadelphia-area

employers (Pennsylvania, New Jersey,

and Delaware).

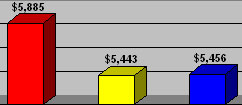

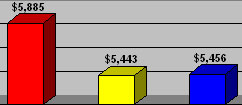

In comparison to the local

and national markets represented by

Hewitt's study, Penn's total health

care costs per employee are above

average, at over $5,800 per employee

per year. This means that we're paying

about 8% more per employee than most

other employers in the nation.

Why are our costs higher

than most employers? Total health

care costs are affected by factors

such as demographics, plan design,

and the financial efficiency of health

plans. All of these contribute to

Penn's high costs.

Demographics

Statistics show that women and older individuals tend to be the most

frequent users of health care

services. Penn employs a higher-than-average

proportion of female and older

workers, which serves to increase

the utilization of our plans

and drive up our health care

costs. According to Hewitt's

study, Penn's costs related to

the age and gender of our employees

are 8% higher than average.

Total

Health Care Costs per Employee

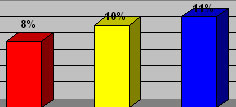

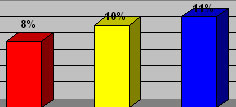

Plan Design Richness

Penn's plans offer richer benefits than most employers in the local

and national markets. Employee

out-of-pocket costs for our plans

average just 8% of the total

plan costs, compared to 10% and

11% for the local and national

markets respectively.

Employee

Out-of-Pocket Costs

Financial Efficiency of Health

Plans

As part of Hewitt's study,

analysts calculate what's called the

financial efficiency of health care

plans. This measure compares the total

costs of all health plans against

each other to see how efficiently

they operate. A financial efficiency

score of 100% is the average across

all plans. Scores above 100% represent

a higher-than-average efficiency,

and scores below 100% represent a

lower-than-average efficiency. Penn's

overall score has decreased from 107%

in fiscal year 2002 to 95% in the

current fiscal year, indicating that

the financial efficiency of our health

plans has fallen to a below-average

level compared to the other companies

included in the study. The main reason

for this decrease has been the high

rate of utilization of our plans by

our employees (see Why are Health Care Costs Rising?, above).

Despite these financial challenges,

Penn still provides a competitive

benefits package to our employees.

In particular, the HMO plans offered

by Penn present the most cost-effective

option to employees, with total employee

costs well below the local and national

averages.

Total

Employee Costs-HMO

|

Total

Employer Costs-HMO

Plans

|

Look for More Information

Look for more information

in next week's Almanac as the "Health

Care and Penn" series continues. For

questions about the health benefits

offered by Penn, visit the HR website

at www.hr.upenn.edu/benefits or

call the Penn Benefits Center at 1-888-PENNBEN

(1-888-736-6236).

--Division of Human Resources

|